As promised by Pakatan Harapan as part of its election manifesto, the hugely unpopular GST has been scrapped as of 1 June 2018 to be replaced by the Sales and Service Tax (SST) from 1 September. Will the move from GST to SSTreally make a difference to consumers, business and the country?

The Move From GST to SST

By Datuk Seri Raymond Liew

As promised by Pakatan Harapan as part of its election manifesto, the hugely unpopular GST has been scrapped as of 1 June 2018 to be replaced by the Sales and Service Tax (SST) from 1 September. Will the move from GST to SSTreally make a difference to consumers, business and the country?

The political tsunami of 9th May 2018 saw the Pakatan Harapan (PH) led by former Prime Minister Tun Dr Mahathir, sweep into power. Tun Dr Mahathir, who led the country during the Asian Financial Crisis of 1997 is once again at the helm of the country as he tries to steer it through rough economic times.One of PH’s election manifesto is to abolish the hugely unpopular Goods and Services Tax (GST) which was blamed as the cause for the rising prices that affected the middle and lower income Malaysians. The Ministry of Finance announced on 16th May 2018 that the GST will be zero-rated effective 1st June 2018.

Out GST, in SST!

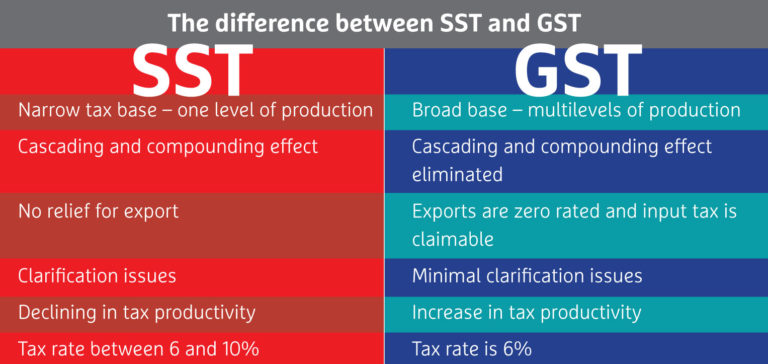

The GST will be replaced with the Sales and Service Tax (SST) which will be introduced on 1st September. The proposed tax rate for the SST is 10%. As SST has a “narrow tax base” the overall impact on business is not as drastic as GST since it only affects certain products and services and does not cascade across the board like the GST. The three month interim period between 0% GST and the onset of the SST is considered a tax holiday for consumers where they hope prices will hopefully come down.

Hopefully the transition will be smooth for the businesses as there is an urgent need for frank dialogues and discussions between the Government and businesses. The Government has always been pro-businesses and I am confident that the transition will be smooth for the businesses as there will be rounds of dialogues and discussions between the Government and businesses as the Government gathers views on SST.

Impact of SST

The change to 0% GST should improve the cash flow of businesses, especially SMEs. However, it may have little impact on bigger businesses which are primarily exporting their products or services.

Consumers can expect food, beverage and retail prices to be lower. Property prices, especially newer houses, automobiles and air travel can also expect to be lower marginal. SST is expected to create more disposable income, which will translate into boosting consumer spending, spur private consumption and increase business activity.

However, there is a possibility that products and services covered under SST will see an increase in prices. In the months between the abolition of GST and introduction of the SST, some unscrupulous parties may take advantage of the situation and engage in non-compliance and profiteering. It is very important that the Government carries out monitoring and enforcement activities effectively.

We applaud the Government’s efforts to strengthen the economy by whatever means. We hope that the SST will be a better tax system than the GST– that it will bring in the extra revenue needed by the Government without causing hardship to the people.

Datuk Seri Raymond Liew is McMillan Woods’ managing partner, a chartered accountant and tax advisor.

News Articles

McM Articles

Events

Financial Crisis Reports

2026-02 McM crisis report 02

2026-01 McM crisis report 01

2025-12 McM crisis report 12

2025-11 McM crisis report 11

2025-10 McM crisis report 10

2025-09 McM crisis report 09

2025-08 McM crisis report 08

2025-07 McM crisis report 07

2025-06 McM crisis report 06

2025-05 McM crisis report 05

2025-04 McM crisis report 04

2025-03 McM crisis report 03

2025-02 McM crisis report 02

2025-01 McM crisis report 01

- Archives -